Why most strategic initiatives fail before they start—and how to build execution discipline that...

Value Chain Optimization Model: A Strategic Tool for MidMarket Leaders

A proven framework to identify internal barriers and build a value chain ready for scale

Executive Briefing

Most mid-market companies hit a point where growth slows—not because demand disappears or talent vanishes, but because internal systems, roles, and decision structures haven’t evolved fast enough to keep up.

This is what we call the Revenue Growth Ceiling—a predictable plateau that appears at key revenue milestones like USD 10M, 25M, and 50M. These stalls are rarely caused by market forces. They’re structural. And they usually catch leadership teams by surprise.

Common symptoms—leadership bottlenecks, stagnant margins, slow decisions, and rising turnover—signal that the current operating model can no longer support the next level of scale. Yet many organizations mistake revenue growth for scalability, continuing to run a playbook that no longer fits the stage they’ve reached.

To break through, companies must move beyond intuition and start managing scale with structure. That means aligning leadership behavior, process design, financial strategy, and execution systems to the company’s next stage—not its past.

The Teel Value Chain Optimization Model (VCOM)™ was built to do just that. It gives leaders a clear, repeatable way to identify internal misalignments, correct them before they stall momentum, and build a foundation for sustainable, scalable growth.

This article outlines how the VCOM works, how to apply it to your current growth barriers, and why the companies that scale successfully are the ones that evolve by design—not by accident.

What the Financials Didn’t Say

EVERY MONTH for about the last twenty years, whether it’s the companies that I was employed in during my corporate career or the client companies I service now in private practice, I sit down with the month-end financials — not just to check where we landed, but to trace how we got there.

The financials tell me what happened but never why. I’m looking at more than numbers. I’m thinking about and studying what behaviors, decisions, and systems produced them. What people did. What policies worked. What processes broke. What leadership signaled, directly or indirectly. What the sales team pushed, and what the market pulled back on.

This has become a ritual. Month after month, client after client, I find myself asking the same four questions:

- What are people doing — or not doing — that’s impacting results?

- What policies, processes, procedures, and routines are shaping outcomes?

- What philosophies, assumptions, priorities, or blind spots in leadership are influencing those behaviors?

- What’s happening upstream in marketing, sales pipeline development, and lead conversion?

In my practice today, where I’m advising as a CFO, the financial portion of the monthly management meeting is quick. Forecasts are accurate. Variances are small. Five minutes, and we’re aligned.

Then we shift.

For the rest of the hour, I’m no longer the CFO. I’m the strategist in the room — unpacking why the numbers look the way they do, and what we can do about it. We revisit open issues. We dissect recurring friction. We start naming the patterns.

Eventually, those conversations began clustering around five recurring domains — even though I didn’t call them that at the time. They were just the areas that kept surfacing. The fault lines. The pressure points.

Looking back, I realize I was seeing companies the way I learned to see them early in my career — through the lens of Michael Porter’s value chain. That model burned itself into my thinking years ago. And over time, it became second nature. When a business issue came up, I wasn’t just hearing the problem. I was seeing the structure behind it in my mind’s eye.

Somewhere along the way, what started as instinct became a system. Not a theory — a tool. Something repeatable. Something that worked.

That’s how the model emerged. Quietly, over years of doing the work. Built not in a conference room, but in conversations with CxOs that mattered.

From Pattern to Framework

Eventually, I realized I wasn’t just solving problems — I was running the same diagnostic loop over and over. Different companies. Same blind spots. Same friction points. And always, the same five areas telling the story.

That’s when I stepped back and formalized what had already become second nature: a way to see the business as a connected system, not a collection of business functions. What emerged is what I now call the Teel Value Chain Optimization Model (VCOM)™ — a structured lens for identifying where your growth is stalling, and why.

This model doesn’t try to fix everything at once. It focuses on what actually drives strategic traction: five interconnected components that either move the business forward — or quietly hold it back.

Growth ceilings aren't roadblocks—they're a call to adapt. Companies that break through are those that recognize constraints early and take decisive action before they stall[1]. The VCOM is used to frame the problems and provide a structured approach to identifying internal barriers, streamlining decision-making, and ensuring long-term scalability. This requires addressing five key areas:

1. People + Alignment

Ensure leadership and teams are strategically positioned, service providers deliver high-value insights, and collaboration eliminates silos.

2. Processes + Integration

Automate workflows while improving cross-functional collaboration to remove inefficiencies and bottlenecks.

3. Financial Strategy + Metrics

Develop financial systems that ensure working capital efficiency, data-driven decision-making, and performance tracking.

4. Operational Execution + Intelligence

Build disciplined management routines with a focus on proactive decision-making and competitive intelligence.

5. Customer + Market Focus

Foster a culture that prioritizes customer retention, market responsiveness, and long-term strategic growth.

How to Use the Teel Value Chain Optimization Model (VCOM)™

The Teel VCOM isn’t a theoretical model. It’s a diagnostic tool — meant to be used. It works best when applied to a specific growth barrier you're trying to solve.

Here’s how to use it in practice:

1. Identify the Growth Barrier

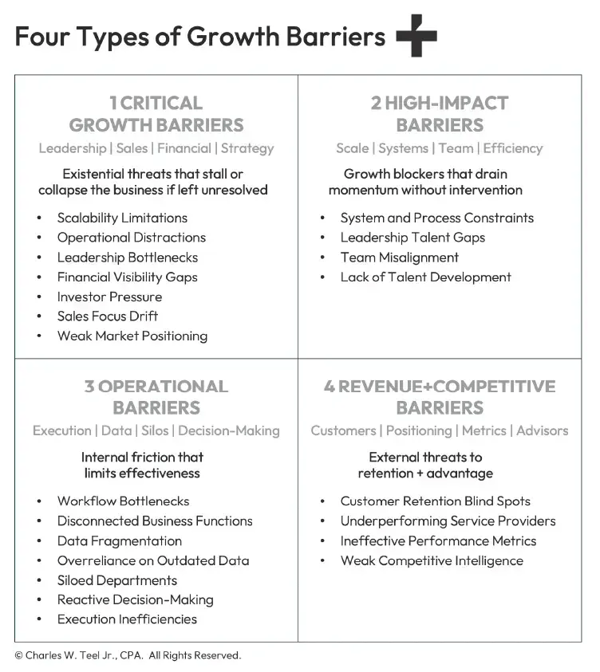

Start by zeroing in on the barrier that’s holding your business back. Most growth issues trace back to a weak or misaligned value chain. I’ve codified twenty-two of the most common barriers — things I’ve seen in every industry, across companies of all sizes. They fall into four categories:

-

Critical Growth Barriers — the ones that will eventually kill the business if left unchecked

-

High-Impact Growth Barriers — serious performance inhibitors

-

Operational Barriers — internal inefficiencies that limit scale

-

Revenue + Competitive Barriers — external-facing weaknesses in market positioning, retention, or pricing power

You can explore more detail on growth barriers at GrowthBarriersRX.com. The following is an overview of the four types of growth barriers.

2. Spot the Signs

Each barrier presents with symptoms — delayed decisions, missed forecasts, customer churn, margin compression, team confusion. Use the VCOM’s five components to assess where those symptoms are showing up, and which part of the value chain is underperforming.

3. Develop the Right Tactics

Once the friction is diagnosed, use the framework to guide the fix. Are your processes inefficient? Is your leadership misaligned? Are you missing competitive intelligence in your ops review? The VCOM gives you a structured lens to pinpoint root causes and develop tactics that address them.

4. Execute and Optimize

The final step is where most companies fall short. Diagnosis is easy. Execution is hard. Use the model to keep pressure on the right levers and reinforce cross-functional accountability. The goal isn’t just to fix a problem — it’s to optimize the value chain and remove friction from growth entirely.

Practical Application: Start by identifying a specific growth barrier—an area where performance is stalled, results are inconsistent, or execution is falling short. Most growth issues are symptoms of a weak or misaligned value chain. Once the barrier is defined, use the VCOM to analyze where the breakdown is occurring across the five components: People, Processes, Financial Strategy, Operational Execution, or Customer Focus. Then assess how your internal functions (Finance, HR, IT) and core revenue activities (Sales, Ops, Fulfillment) are enabling—or hindering—performance in that business function. The VCOM’s modular design allows you to isolate the constraint, develop targeted interventions, and resolve issues without a full-scale reorg. For CxOs, it turns strategic friction into focused action—and transforms operational complexity into scalable execution.

Scaling by Design, Not by Accident

Hitting a growth plateau isn't a sales problem—it's a structural issue. Businesses that scale beyond $10M, $50M, or $100M have one thing in common: they fix scalability issues before they become limitations [4][5].

Revenue growth does not guarantee scalability. By recognizing the hidden financial and strategic barriers, businesses can proactively identify and eliminate roadblocks before they stall momentum. The key to sustainable expansion lies in aligning financial strategy, operational efficiency, and leadership autonomy to foster a scalable, high-growth organization.

In my work with dozens of companies facing these challenges, we've consistently found that companies don't scale by accident—they scale by design. Leaders who understand their barriers control their trajectory [6].

Closing Assessment: Are You Hitting a Growth Ceiling?

- Is your company growing in revenue but not in profitability?

- Are strategic initiatives consistently delayed by operational firefighting?

- Do decisions require multiple approvals, causing delays in market response?

- Are your best employees leaving due to lack of career advancement?

- Has your management team remained unchanged despite significant revenue growth?

If you answered "yes" to three or more of these questions, your company may be approaching—or has already hit—a growth ceiling. The good news? Recognizing these barriers is the first step toward breaking through them.

References

[1] Olson, M. S., Van Bever, D., & Verry, S. (2008, March). When growth stalls. Harvard Business Review.

[2] Gagné, M., & Hewett, R. (2025, February 18). What leaders get wrong about employee motivation. MIT Sloan Management Review, 66(3), 45–57.

[3] Gandhi, S. (2023, October 18). What fast-moving companies do differently. Harvard Business Review.

[4] Ashkenas, R. (2013, June 11). Why successful companies stop growing. Harvard Business Review.

[5] Flesner, P. (2023, October 3). How to get beyond the revenue growth plateau. Inc. Magazine.

[6] Slywotzky, A. J., & Wise, R. (2002, July). The growth crisis—and how to escape it. Harvard Business Review, 80(7), 81–91.

Copyright © 2025, Charles W. Teel Jr., CPA, LLC. All Rights Reserved.